Economic Growth

Economists Raise China Growth Forecasts as Exports Improve

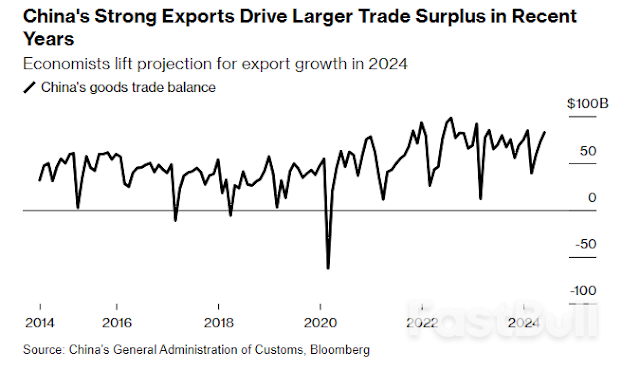

The outlook for China’s exports is set to improve, buttressing growth in the world’s second-biggest economy even as consumer spending slows, according to a Bloomberg survey of economists.

Exports are expected to climb 4.3% this year from a year ago, according to the median forecast of 22 economists surveyed over June 17-24. That’s a jump from the 2.8% gain forecast in a May survey. China’s economy may expand 5%, up from the 4.9% projected in May, according to the median of 68 estimates.

“We look for an improving trade outlook over the coming months, driven by a shift in global demand from services back to goods,” said Serena Zhou, senior China economist at Mizuho Securities Asia Ltd.

China’s exports beat expectations in April and May, reflecting strong demand from overseas and the increasing competitiveness of Chinese producers. While this supports Beijing’s strategy of relying on exports to spur growth and offset weak spending by Chinese households, risks are mounting as its companies start to face more trade barriers from the US and Europe.

The survey findings contrast with a recent report by Goldman Sachs Group Inc., which said its clients in China are increasingly skeptical about the outlook for export growth in the coming quarters. Investors are worried about the sustainability of supply-side expansion, especially when domestic demand is weak, and the risks of trade friction, the bank said in the note dated June 23.

Economists have pared back their expectations for retail sales growth — a key gauge of consumer spending — as well as consumer and factory-gate price inflation this year, reflecting pessimism over demand as a sharp housing contraction continues, according to the Bloomberg survey.

“Recent macro data confirm that drags from the property sector remain,” said Arjen van Dijkhuizen, senior economist at ABN Amro Bank NV. “Growth is still supported by a stronger momentum in exports, but external risks are rising, as China’s overcapacity contributes to trade spats, with the US and Europe trying to protect strategic industries.”

China is unlikely to shake off deflationary pressures this year, with economists becoming more downbeat about the prospects. They expect consumer price index to rise only 0.6% this year, while producer price index is forecast to drop 1%, both weakening from the estimates in May.

This reflects consumers’ reluctance to spend money amid concerns about their job security, income prospects and falling property values.

“Strains in the job market are still weighing on consumer spending,” said Erica Tay, an economist at Maybank Investment Banking Group. “Even as the advanced manufacturing sectors are winning global market share, their gains can only go so far in offsetting the drag to GDP growth from sluggish consumption.”

Economists pushed back their expectations for a cut to the reserve requirement ratio — the amount of cash banks must set in reserve — to the third quarter from the second quarter. The PBOC held off on easing in recent months to protect the yuan and as market liquidity was ample.

They also projected a slower growth of money supply this year compared to May, as the central bank signaled a shift in focus to the efficiency of funds rather than pure expansion. Economists maintained their projections for policy interest rates and the loan prime rate to be cut in the third quarter.

Thanks for reading, stay tuned for more economy updates..